Definition: Collision insurance is a type of auto insurance coverage that helps pay for damages to your vehicle resulting from a collision with another vehicle or object. This coverage is designed to protect against financial loss from accidents where your car is damaged, regardless of who is at fault.

Key Features of Collision Insurance

- Coverage for Collision-Related Damage:

- Description: Collision insurance covers repair or replacement costs for your vehicle if it is damaged in a crash with another vehicle or a stationary object, such as a tree, fence, or guardrail.

- Examples: If you hit another car or your vehicle is involved in a rollover, collision insurance will help cover the costs of repairs or replacement.

- Deductibles:

- Description: When you file a claim under collision insurance, you are typically required to pay a deductible before the insurance coverage kicks in.

- Typical Deductibles: Deductibles can vary, often ranging from $250 to $1,000 or more, depending on your policy and preferences.

- Replacement Cost:

- Description: If your vehicle is declared a total loss (i.e., the cost to repair it exceeds its value), collision insurance will cover the cost of replacing the vehicle up to its actual cash value (ACV), minus the deductible.

- ACV Calculation: The ACV is determined based on the vehicle’s market value before the accident, accounting for depreciation.

- Exclusions:

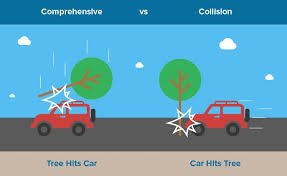

- Description: Collision insurance does not cover damages caused by non-collision events such as theft, vandalism, or natural disasters. For these types of incidents, comprehensive insurance is needed.

- Examples: Damage from a hailstorm, theft of the vehicle, or damage caused by an animal would not be covered under collision insurance.

Benefits of Collision Insurance

- Financial Protection:

- Description: Provides financial protection by covering repair or replacement costs, helping you avoid significant out-of-pocket expenses after an accident.

- Benefit: Essential for maintaining financial stability if you are involved in an accident that damages your vehicle.

- Peace of Mind:

- Description: Offers peace of mind knowing that you have coverage for damages resulting from collisions, allowing you to focus on recovery and other aspects of handling the accident.

- Benefit: Reduces stress and uncertainty following an accident by providing a clear path for repair or replacement.

- Required by Lenders:

- Description: If you have a car loan or lease, your lender or leasing company may require you to carry collision insurance to protect their investment in your vehicle.

- Benefit: Ensures compliance with loan or lease terms and prevents potential financial complications if an accident occurs.

How Collision Insurance Fits Into Your Auto Insurance Policy

- Part of a Comprehensive Auto Insurance Policy: Collision insurance is often included in a comprehensive auto insurance policy, which combines various types of coverage such as liability, comprehensive, and collision.

- Optional Coverage: Unlike liability insurance, which is typically mandatory, collision insurance is optional. However, it is highly recommended for those who want to protect their vehicle against collision-related damage.

Conclusion

Collision insurance provides valuable protection by covering the costs associated with repairing or replacing your vehicle after a collision. It offers financial security and peace of mind, especially for individuals with significant investments in their vehicles or those who are required by lenders to maintain coverage. Understanding the scope of collision insurance and how it complements other types of coverage can help you make informed decisions about your auto insurance policy.